(updated September 2011)

- Uranium is a relatively common metal, found in rocks and seawater. Economic concentrations of it are not uncommon.

- Its availability to supply world energy needs is great both geologically and because of the technology for its use.

- Quantities of mineral resources are greater than commonly perceived.

- The world's known uranium resources increased 15% in two years to 2007 due to increased mineral exploration.

Uranium is a relatively common element in the crust of the Earth (very much more than in the mantle). It is a metal approximately as common as tin or zinc, and it is a constituent of most rocks and even of the sea. Some typical concentrations are: (ppm = parts per million).

| Very high-grade ore (Canada) - 20% U | 200,000 ppm U |

|---|---|

| High-grade ore - 2% U, | 20,000 ppm U |

| Low-grade ore - 0.1% U, | 1,000 ppm U |

| Very low-grade ore* (Namibia) - 0.01% U | 100 ppm U |

| Granite | 3-5 ppm U |

| Sedimentary rock | 2-3 ppm U |

| Earth's continental crust (av) | 2.8 ppm U |

| Seawater | 0.003 ppm U |

* Where uranium is at low levels in rock or sands (certainly less than 1000 ppm) it needs to be in a form which is easily separated for those concentrations to be called "ore" - that is, implying that the uranium can be recovered economically. This means that it need to be in a mineral form that can easily be dissolved by sulfuric acid or sodium carbonate leaching.

An orebody is, by definition, an occurrence of mineralisation from which the metal is economically recoverable. It is therefore relative to both costs of extraction and market prices. At present neither the oceans nor any granites are orebodies, but conceivably either could become so if prices were to rise sufficiently.

Measured resources of uranium, the amount known to be economically recoverable from orebodies, are thus also relative to costs and prices. They are also dependent on the intensity of past exploration effort, and are basically a statement about what is known rather than what is there in the Earth's crust - epistemology rather than geology. See Appendix 2 for mineral resource and reserve categories.

Changes in costs or prices, or further exploration, may alter measured resource figures markedly. At ten times the current price, seawater might become a potential source of vast amounts of uranium. Thus, any predictions of the future availability of any mineral, including uranium, which are based on current cost and price data and current geological knowledge are likely to be extremely conservative.

From time to time concerns are raised that the known resources might be insufficient when judged as a multiple of present rate of use. But this is the Limits to Growth fallacy, a major intellectual blunder recycled from the 1970s, which takes no account of the very limited nature of the knowledge we have at any time of what is actually in the Earth's crust. Our knowledge of geology is such that we can be confident that identified resources of metal minerals are a small fraction of what is there. Factors affecting the supply of resources are discussed further and illustrated in the Appendix.

Uranium availability

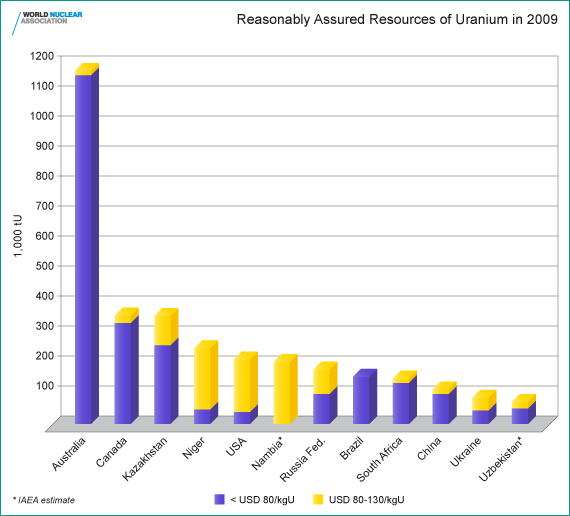

With those major qualifications the following Table gives some idea of our present knowledge of uranium resources. The total and several country figures are lower than two years earlier due to economic factors, notably inflation of production costs. It can be seen that Australia has a substantial part (about 31 percent) of the world's uranium, Kazakhstan 12 percent, and Canada 9 percent. In the next lowest-cost category, Australia has a much higher proportion (43%).

Known Recoverable Resources of Uranium 2009

| tonnes U | percentage of world | |

| Australia |

1,673,000

|

31%

|

|---|---|---|

| Kazakhstan |

651,000

|

12%

|

| Canada |

485,000

|

9%

|

| Russia |

480,000

|

9%

|

| South Africa |

295,000

|

5%

|

| Namibia |

284,000

|

5%

|

| Brazil |

279,000

|

5%

|

| Niger |

272,000

|

5%

|

| USA |

207,000

|

4%

|

| China |

171,000

|

3%

|

| Jordan |

112,000

|

2%

|

| Uzbekistan |

111,000

|

2%

|

| Ukraine |

105,000

|

2%

|

| India |

80,000

|

1.5%

|

| Mongolia |

49,000

|

1%

|

| other |

150,000

|

3%

|

| World total |

5,404,000

|

Reasonably Assured Resources plus Inferred Resources, to US$ 130/kg U, 1/1/09, from OECD NEA & IAEA, Uranium 2009: Resources, Production and Demand ("Red Book").

Current usage is about 68,000 tU/yr. Thus the world's present measured resources of uranium (5.4 Mt) in the cost category slightly above present spot prices and used only in conventional reactors, are enough to last for about 80 years. This represents a higher level of assured resources than is normal for most minerals. Further exploration and higher prices will certainly, on the basis of present geological knowledge, yield further resources as present ones are used up.

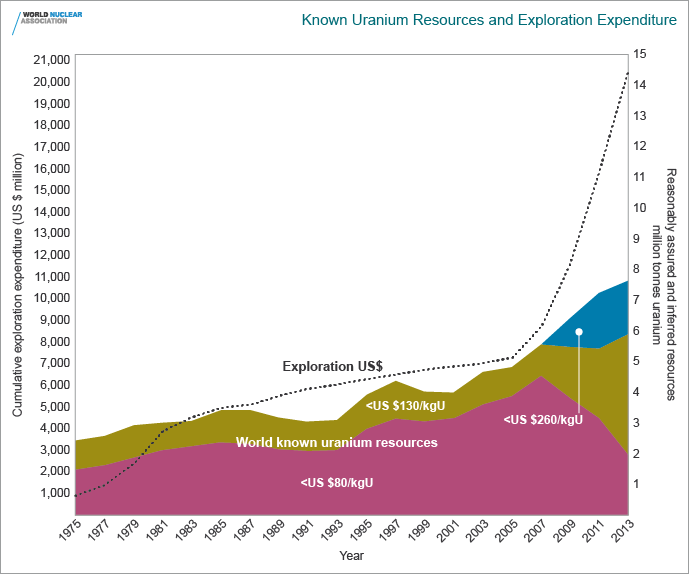

An initial uranium exploration cycle was military-driven, over 1945 to 1958. The second cycle was about 1974 to 1983, driven by civil nuclear power and in the context of a perception that uranium might be scarce. There was relatively little uranium exploration between 1985 and 2003, so the significant increase in exploration effort since then could conceivably double the known economic resources despite adjustments due to increasing costs. In the two years 2005-06 the world’s known uranium resources tabulated above and graphed below increased by 15% (17% in the cost category to $80/kgU). World uranium exploration expenditure in 2006 was US$ 705 million, in 2007 $1328 million, and in 2008 $1641 million. In the third uranium exploration cycle from 2003 to the end of 2009 about US$ 5.75 billion was spent on uranium exploration and deposit delineation on over 600 projects. In this period over 400 new junior companies were formed or changed their orientation to raise over US$ 2 billion for uranium exploration. About 60% of this was spent on previously-known deposits. All this was in response to increased uranium price in the market.

The price of a mineral commodity also directly determines the amount of known resources which are economically extractable. On the basis of analogies with other metal minerals, a doubling of price from present levels could be expected to create about a tenfold increase in measured economic resources, over time, due both to increased exploration and the reclassification of resources regarding what is economically recoverable.

This is in fact suggested in the IAEA-NEA figures if those covering estimates of all conventional resources are considered - another 5.5 million tonnes (beyond the 5.4 Mt known economic resources), which takes us to 160 years' supply at today's rate of consumption. This still ignores the technological factor mentioned below. It also omits unconventional resources such as phosphate/ phosphorite deposits (22 Mt U recoverable as by-product) and seawater (up to 4000 Mt), which would be uneconomic to extract in the foreseeable future.

It is clear from this Figure that known uranium resources have increased almost threefold since 1975, in line with expenditure on uranium exploration. (The decrease in the decade 1983-93 is due to some countries tightening their criteria for reporting. If this were carried back two decades, the lines would fit even more closely. The change from 2007 to 2009 is due to reclassifying resources into higher-cost categories.) Increased exploration expenditure in the future is likely to result in a corresponding increase in known resources, even as inflation increases costs of recovery and hence tends to decrease the figures in each cost category.

About 20% of US uranium came from central Florida's phosphate deposits to the mid 1990s, as a by-product, but it then became uneconomic. With higher uranium prices today the resource is being examined again, as is another lower-grade one in Morocco. Plans for Florida extend only to 400 tU/yr at this stage. See also companion paper on Uranium from Phosphate Deposits.

Coal ash is another easily-accessible though minor uranium resource in many parts of the world. In central Yunnan province in China the coal uranium content varies up to 315 ppm and averages about 65 ppm. The ash averages about 210 ppm U (0.021%U) - above the cut-off level for some uranium mines. The Xiaolongtang power station ash heap contains over 1000 tU, with annual arisings of 190 tU. Recovery of this by acid leaching is about 70% in trials. This project has yet to announce any commercial production, however.

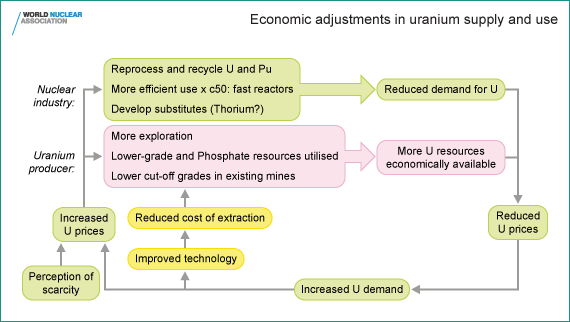

Widespread use of the fast breeder reactor could increase the utilisation of uranium 50-fold or more. This type of reactor can be started up on plutonium derived from conventional reactors and operated in closed circuit with its reprocessing plant. Such a reactor, supplied with natural or depleted uranium for its "fertile blanket", can be operated so that each tonne of ore yields 60 times more energy than in a conventional reactor.

see also WNA position paper.

Reactor Fuel Requirements

The world’s power reactors, with combined capacity of some 375 GWe, require about 68,000 tonnes of uranium from mines or elsewhere each year. While this capacity is being run more productively, with higher capacity factors and reactor power levels, the uranium fuel requirement is increasing, but not necessarily at the same rate. The factors increasing fuel demand are offset by a trend for higher burn-up of fuel and other efficiencies, so demand is steady. (Over the years 1980 to 2008 the electricity generated by nuclear power increased 3.6-fold while uranium used increased by a factor of only 2.5.)

Reducing the tails assay in enrichment reduces the amount of natural uranium required for a given amount of fuel. Reprocessing of used fuel from conventional light water reactors also utilises present resources more efficiently, by a factor of about 1.3 overall.

Today's reactor fuel requirements are met from primary supply (direct mine output - 78% in 2009) and secondary sources: commercial stockpiles, nuclear weapons stockpiles, recycled plutonium and uranium from reprocessing used fuel, and some from re-enrichment of depleted uranium tails (left over from original enrichment). These various secondary sources make uranium unique among energy minerals.

Nuclear Weapons as a source of fuel

An important source of nuclear fuel is the world's nuclear weapons stockpiles. Since 1987 the United States and countries of the former USSR have signed a series of disarmament treaties to reduce the nuclear arsenals of the signatory countries by approximately 80 percent.

The weapons contained a great deal of uranium enriched to over 90 percent U-235 (ie up to 25 times the proportion in reactor fuel). Some weapons have plutonium-239, which can be used in mixed-oxide (MOX) fuel for civil reactors. From 2000 the dilution of 30 tonnes of military high-enriched uranium has been displacing about 10,600 tonnes of uranium oxide per year from mines, which represents about 15% of the world's reactor requirements.

Details of the utilisation of military stockpiles are in the paper Military warheads as a source of nuclear fuel.

Other secondary sources of uranium

The most obvious source is civil stockpiles held by utilities and governments. The amount held here is difficult to quantify, due to commercial confidentiality. As at January 2009 some 129,000 tU total inventory was estimated for utilities, 10,000 tU for producers and 15,000 tU for fuel cycle participants, making a total of 154,000 tU (WNA Market Report). These reserves are expected not to be drawn down, but to increase steadily to provide energy security for utilities and governments.

Recycled uranium and plutonium is another source, and currently saves 1500-2000 tU per year of primary supply, depending on whether just the plutonium or also the uranium is considered. In fact, plutonium is quickly recycled as MOX fuel, whereas the reprocessed uranium (RepU) is mostly stockpiled. See also Processing of Used Nuclear Fuel for Recycle paper.

Re-enrichment of depleted uranium (DU, enrichment tails) is another secondary source. There is about 1.5 million tonnes of depleted uranium available, from both military and civil enrichment activity since the 1940s, most at tails assay of 0.25 - 0.35% U-235. Non-nuclear uses of DU are very minor relative to annual arisings of over 35,000 tU per year. This leaves most DU available for mixing with recycled plutonium on MOX fuel or as a future fuel resource for fast neutron reactors. However, some that has relatively high assay can be fed through under-utilised enrichment plants to produce natural uranium equivalent, or even enriched uranium ready for fuel fabrication. Russian enrichment plants have treated 10-15,000 tonnes per year of DU assaying over 0.3% U-235, stripping it down to 0.1% and producing a few thousand tonnes per year of natural uranium equivalent. This Russian program treating Western tails has now finished, but a new US one is expected to start when surplus capacity is available, treating about 140,000 tonnes of old DU assaying 0.4% U-235.

International fuel reserves

There have been three major initiatives to set up international reserves of enriched fuel, two of them multilateral ones, with fuel to be available under International Atomic Energy Agency (IAEA) auspices despite any political interruptions which might affect countries needing them. The third is under US auspices, and also to meet needs arising from supply disruptions.

In November 2009 the IAEA Board approved a Russian proposal to create an international "fuel bank" or guaranteed reserve of low-enriched uranium under IAEA control at the International Uranium Enrichment Centre (IUEC) at Angarsk. This Russian LEU reserve was established a year later and comprises 120 tonnes of low-enriched uranium as UF6, enriched 2.0 - 4.95% U-235 (with 40t of latter), available to any IAEA member state in good standing which is unable to procure fuel for political reasons. It is fully funded by Russia, held under safeguards, and the fuel will be made available to IAEA at market rates, using a formula based on spot prices. Following an IAEA decision to allocate some of it, Rosatom will transport material to St Petersburg and transfer title to IAEA, which will then transfer ownership to the recipient.

This initiative complements the proposed IAEA fuel bank by making more material available to the IAEA for assurance of fuel supply to countries without their own fuel cycle facilities. The 120 tonnes uranium as UF6 is equivalent to two full fuel loads for a typical 1000 MWe reactor, and is (in 2011) worth some US$ 250 million.

In December 2010 the IAEA board resolved to establish a similar guaranteed reserve of low-enriched uranium, the IAEA LEU bank, with the support of $50 million from the US-based Nuclear Threat Initiative (NTI) organization and US billionaire Warren Buffett, plus a matching $107 million from the US government ($50 million), the EU ($32 million), UAE ($10 million), Kuwait ($10 million) and Norway ($5 million). The IAEA is drawing up a framework that defines the "fuel bank's" structure, access and location. It will comprise a physical stock of UF6 at enrichment levels ranging up to 4.95% U-235 and owned by the IAEA, which shall "be responsible for storing and protecting" it. A comprehensive Host State Agreement will need to provide for the IAEA facility to be extraterritorial. Kazakhstan has offered to host it. See IAEA Factsheet.

There have been three major initiatives to set up international reserves of enriched fuel, two of them multilateral ones, with fuel to be available under International Atomic Energy Agency (IAEA) auspices despite any political interruptions which might affect countries needing them. The third is under US auspices, and also to meet needs arising from supply disruptions.

In November 2009 the IAEA Board approved a Russian proposal to create an international "fuel bank" or guaranteed reserve of low-enriched uranium under IAEA control at the International Uranium Enrichment Centre (IUEC) at Angarsk. This Russian LEU reserve was established a year later and comprises 120 tonnes of low-enriched uranium as UF6, enriched 2.0 - 4.95% U-235 (with 40t of latter), available to any IAEA member state in good standing which is unable to procure fuel for political reasons. It is fully funded by Russia, held under safeguards, and the fuel will be made available to IAEA at market rates, using a formula based on spot prices. Following an IAEA decision to allocate some of it, Rosatom will transport material to St Petersburg and transfer title to IAEA, which will then transfer ownership to the recipient.

This initiative complements the proposed IAEA fuel bank by making more material available to the IAEA for assurance of fuel supply to countries without their own fuel cycle facilities. The 120 tonnes uranium as UF6 is equivalent to two full fuel loads for a typical 1000 MWe reactor, and is (in 2011) worth some US$ 250 million.

In December 2010 the IAEA board resolved to establish a similar guaranteed reserve of low-enriched uranium, the IAEA LEU bank, with the support of $50 million from the US-based Nuclear Threat Initiative (NTI) organization and US billionaire Warren Buffett, plus a matching $107 million from the US government ($50 million), the EU ($32 million), UAE ($10 million), Kuwait ($10 million) and Norway ($5 million). The IAEA is drawing up a framework that defines the "fuel bank's" structure, access and location. It will comprise a physical stock of UF6 at enrichment levels ranging up to 4.95% U-235 and owned by the IAEA, which shall "be responsible for storing and protecting" it. A comprehensive Host State Agreement will need to provide for the IAEA facility to be extraterritorial. Kazakhstan has offered to host it. See IAEA Factsheet.

In 2005 the US government announced plans for the establishment of a mechanism to ensure fuel supply for use in commercial reactors in foreign countries where there has been supply disruption. The fuel would come from downblending 17.4 tonnes of high-enriched uranium (HEU). In August 2011 US Department of Energy announced an expanded scope for the program so it would also serve US utility needs, and now be called the American Assured Fuel Supply (AFS). At that point most of the downblending of the HEU had been completed, and the scheme was ready to operate. The AFS will comprise about 230 tonnes of low-enriched uranium (with another 60t from downblending being sold on the market to pay for the work). The AFS program is administered by the US National Nuclear Safety Administration, foreign access must be through a US entity, and the fuel will be sold at current market prices. The 230 t amount is equivalent to about six reloads for a 1000 MWe reactor.

Thorium as a nuclear fuel

Today uranium is the only fuel supplied for nuclear reactors. However, thorium can also be utilised as a fuel for CANDU reactors or in reactors specially designed for this purpose. Neutron efficient reactors, such as CANDU, are capable of operating on a thorium fuel cycle, once they are started using a fissile material such as U-235 or Pu-239. Then the thorium (Th-232) atom captures a neutron in the reactor to become fissile uranium (U-233), which continues the reaction. Some advanced reactor designs are likely to be able to make use of thorium on a substantial scale.

The thorium fuel cycle has some attractive features, though it is not yet in commercial use. Thorium is reported to be about three times as abundant in the earth's crust as uranium. The 2009 IAEA-NEA "Red Book" lists 3.6 million tonnes of known and estimated resources as reported, but points out that this excludes data from much of the world, and estimates about 6 million tonnes overall. See also companion paper on Thorium.

Main references

OECD NEA & IAEA, 2010, Uranium 2009: Resources, Production and Demand

WNA 2009 Market Report

UN Institute for Disarmament Research, Yury Yudin (ed) 2011, Multilateralization of the Nuclear Fuel Cycle - The First Practical Steps.

OECD NEA & IAEA, 2010, Uranium 2009: Resources, Production and Demand

WNA 2009 Market Report

UN Institute for Disarmament Research, Yury Yudin (ed) 2011, Multilateralization of the Nuclear Fuel Cycle - The First Practical Steps.

Substantially derived from 2003 WNA Symposium paper by Colin MacDonald, Uranium: Sustainable Resource or Limit to Growth? - supplemented by his 2005 WNA Symposium paper and including a model "Economic adjustments in the supply of a 'non-renewable' resource" from Ian Hore-Lacy.

The Sustainability of Mineral Resources

with reference to uranium

with reference to uranium

It is commonly asserted that because "the resources of the earth are finite", therefore we must face some day of reckoning, and will need to plan for "negative growth". All this, it is pointed out, is because these resources are being consumed at an increasing rate to support our western lifestyle and to cater for the increasing demands of developing nations. The assertion that we are likely to run out of resources is a re-run of the "Limits to Growth" argument (Club of Rome 1972 popularised by Meadows et al in Limits of Growth at that time. (A useful counter to it is W Berckerman, In Defence of Economic Growth, also Singer, M, Passage to a Human World, Hudson Inst. 1987). In the decade following its publication world bauxite reserves increased 35%, copper 25%, nickel 25%, uranium and coal doubled, gas increased 70% and even oil increased 6%.) fashionable in the early 1970s, which was substantially disowned by its originators, the Club of Rome, and shown up as nonsense with the passing of time. It also echoes similar concerns raised by economists in the 1930s, and by Malthus at the end of the 18th Century.

In recent years there has been persistent misunderstanding and misrepresentation of the abundance of mineral resources, with the assertion that the world is in danger of actually running out of many mineral resources. While congenial to common sense if the scale of the Earth's crust is ignored, it lacks empirical support in the trend of practically all mineral commodity prices and published resource figures over the long term. In recent years some have promoted the view that limited supplies of natural uranium are the Achilles heel of nuclear power as the sector contemplates a larger contribution to future clean energy, notwithstanding the small amount of it required to provide very large amounts of energy.

Uranium supply news is usually framed within a short-term perspective. It concerns who is producing with what resources, who might produce or sell, and how does this balance with demand? However, long-term supply analysis enters the realm of resource economics. This discipline has as a central concern the understanding of not just supply/demand/price dynamics for known resources, but also the mechanisms for replacing resources with new ones presently unknown. Such a focus on sustainability of supply is unique to the long view. Normally-functioning metals markets and technology change provide the drivers to ensure that supply at costs affordable to consumers is continuously replenished, both through the discovery of new resources and the re-definition (in economic terms) of known ones.

Of course the resources of the earth are indeed finite, but three observations need to be made: first, the limits of the supply of resources are so far away that the truism has no practical meaning. Second, many of the resources concerned are either renewable or recyclable (energy minerals and zinc are the main exceptions, though the recycling potential of many materials is limited in practice by the energy and other costs involved). Third, available reserves of 'non-renewable' resources are constantly being renewed, mostly faster than they are used.

There are three principal areas where resource predictions have faltered:

- predictions have not accounted for gains in geological knowledge and understanding of mineral deposits;

- they have not accounted for technologies utilised to discover, process and use them;

- economic principles have not been taken into account, which means that resources are thought of only in present terms, not in terms of what will be economic through time, nor with concepts of substitution in mind.

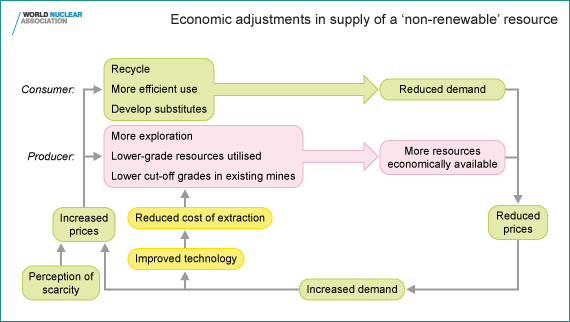

What then does sustainability in relation to mineral resources mean? The answer lies in the interaction of these three things which enable usable resources (Some licence is taken in the use of this word in the following, strictly it is reserves of minerals which are created) effectively to be created. They are brought together in the diagram below.

Numerous economists have studied resource trends to determine which measures should best reflect resource scarcity (Tilton, J. On Borrowed Time? Assessing the threat of mineral depletion, Resources for the Future, Washington DC 2002). Their consensus view is that costs and prices, properly adjusted for inflation, provide a better early warning system for long-run resource scarcity than do physical measures such as resource quantities.

Historic data show that the most commonly used metals have declined in both their costs and real commodity prices over the past century. Such price trends are the most telling evidence of lack of scarcity. Uranium has been a case in point, relative to its late 1970s price of US$ 40/lb U3O8.

An anecdote underlines this basic truth: In 1980 two eminent professors, fierce critics of one another, made a bet regarding the real market price of five metal commodities over the next decade. Paul Ehrlich, a world-famous ecologist, bet that because the world was exceeding its carrying capacity, food and commodities would start to run out in the 1980s and prices in real terms would therefore rise. Julian Simon, an economist, said that resources were effectively so abundant, and becoming effectively more so, that prices would fall in real terms. He invited Ehrlich to nominate which commodities would be used to test the matter, and they settled on these (chrome, copper, nickel, tin and tungsten). In 1990 Ehrlich paid up - all the prices had fallen.

However, quantities of known resources tell a similar and consistent story. To cite one example, world copper reserves in the 1970s represented only 30 years of then-current production (6.4 Mt/yr). Many analysts questioned whether this resource base could satisfy the large expected requirements of the telecommunications industry by 2000. But by 1994, world production of copper had doubled (12 Mt/yr) and the available reserves were still enough for another 30 years. The reserve multiple of current production remained the same.

Metal Prices

Another way to understand resource sustainability is in terms of economics and capital conservation. Under this perspective, mineral resources are not so much rare or scarce as they are simply too expensive to discover if you cannot realise the profits from your discovery fairly soon. Simple economic considerations therefore discourage companies from discovering much more than society needs through messages of reduced commodity prices during times of oversupply. Economically rational players will only invest in finding these new reserves when they are most confident of gaining a return from them, which usually requires positive price messages caused by undersupply trends. If the economic system is working correctly and maximizing capital efficiency, there should never be more than a few decades of any resource commodity in reserves at any point in time.

Resource levels

The fact that many commodities have more resources available than efficient economic theory might suggest may be partly explained by two characteristics of mineral exploration cycles. First, the exploration sector tends to over-respond to the positive price signals through rapid increases in worldwide expenditures (which increases the rate of discoveries), in particular through the important role of more speculatively-funded junior exploration companies. Exploration also tends to make discoveries in clusters that have more to do with new geological knowledge than with efficient capital allocation theory. As an example, once diamonds were known to exist in northern Canada, the small exploration boom that accompanied this resulted in several large discoveries - more than the market may have demanded at this time. These patterns are part of the dynamics that lead to commodity price cycles. New resource discoveries are very difficult to precisely match with far-off future demand, and the historic evidence suggests that the exploration process over-compensates for every small hint of scarcity that the markets provide.

Another important element in resource economics is the possibility of substitution of commodities. Many commodity uses are not exclusive - should they become too expensive they can be substituted with other materials. Even if they become cheaper they may be replaced, as technology gains have the potential to change the style and cost of material usage. For example, copper, despite being less expensive in real terms than 30 years ago, is still being replaced by fibre optics in many communication applications. These changes to materials usage and commodity demand provide yet another dimension to the simple notion of depleting resources and higher prices.

In summary, historic metals price trends, when examined in the light of social and economic change through time, demonstrate that resource scarcity is a double-edged sword. The same societal trends that have increased metals consumption, tending to increase prices, have also increased the available wealth to invest in price-reducing knowledge and technology. These insights provide the basis for the economic sustainability of metals, including uranium.

Geological Knowledge

Whatever minerals are in the earth, they cannot be considered usable resources unless they are known. There must be a constant input of time, money and effort to find out what is there. This mineral exploration endeavour is not merely fossicking or doing aerial magnetic surveys, but must eventually extend to comprehensive investigation of orebodies so that they can reliably be defined in terms of location, quantity and grade. Finally, they must be technically and economically quantified as mineral reserves. That is the first aspect of creating a resource. See Appendix 2 for mineral resource and reserve categories.

For reasons outlined above, measured resources of many minerals are increasing much faster than they are being used, due to exploration expenditure by mining companies and their investment in research. Simply on geological grounds, there is no reason to suppose that this trend will not continue. Today, proven mineral resources worldwide are more than we inherited in the 1970s, and this is especially so for uranium.

Simply put, metals which are more abundant in the Earth's crust are more likely to occur as the economic concentrations we call mineral deposits. They also need to be reasonably extractable from their host minerals. By these measures, uranium compares very well with base and precious metals. Its average crustal abundance of 2.7 ppm is comparable with that of many other metals such as tin, tungsten, and molybdenum. Many common rocks such as granite and shales contain even higher uranium concentrations of 5 to 25 ppm. Also, uranium is predominantly bound in minerals which are not difficult to break down in processing.

As with crustal abundance, metals which occur in many different kinds of deposits are easier to replenish economically, since exploration discoveries are not constrained to only a few geological settings. Currently, at least 14 different types of uranium deposits are known, occurring in rocks of wide range of geological age and geographic distribution. There are several fundamental geological reasons why uranium deposits are not rare, but the principal reason is that uranium is relatively easy both to place into solution over geological time, and to precipitate out of solution in chemically reducing conditions. This chemical characteristic alone allows many geological settings to provide the required hosting conditions for uranium resources. Related to this diversity of settings is another supply advantage ?the wide range in the geological ages of host rocks ensures that many geopolitical regions are likely to host uranium resources of some quality.

Unlike the metals which have been in demand for centuries, society has barely begun to utilise uranium. As serious non-military demand did not materialise until significant nuclear generation was built by the late 1970s, there has been only one cycle of exploration-discovery-production, driven in large part by late 1970s price peaks (MacDonald, C, Rocks to reactors: Uranium exploration and the market. Proceedings of WNA Symposium 2001). This initial cycle has provided more than enough uranium for the last three decades and several more to come. Clearly, it is premature to speak about long-term uranium scarcity when the entire nuclear industry is so young that only one cycle of resource replenishment has been required. It is instead a reassurance that this first cycle of exploration was capable of meeting the needs of more than half a century of nuclear energy demand.

Related to the youthfulness of nuclear energy demand is the early stage that global exploration had reached before declining uranium prices stifled exploration in the mid 1980s. The significant investment in uranium exploration during the 1970-82 exploration cycle would have been fairly efficient in discovering exposed uranium deposits, due to the ease of detecting radioactivity. Still, very few prospective regions in the world have seen the kind of intensive knowledge and technology-driven exploration that the Athabasca Basin of Canada has seen since 1975. This fact has huge positive implications for future uranium discoveries, because the Athabasca Basin history suggests that the largest proportion of future resources will be as deposits discovered in the more advanced phases of exploration. Specifically, only 25% of the 635,000 tonnes of U3O8discovered so far in the Athabasca Basin could be discovered during the first phase of surface-based exploration. A sustained second phase, based on advances in deep penetrating geophysics and geological models, was required to discover the remaining 75%.

Another dimension to the immaturity of uranium exploration is that it is by no means certain that all possible deposit types have even been identified. Any estimate of world uranium potential made only 30 years ago would have missed the entire deposit class of unconformity deposits that have driven production since then, simply because geologists did not know this class existed.

Technology

It is meaningless to speak of a resource until someone has thought of a way to use any particular material. In this sense, human ingenuity quite literally creates new resources, historically, currently and prospectively. That is the most fundamental level at which technology creates resources, by making particular minerals usable in new ways. Often these then substitute to some degree for others which are becoming scarcer, as indicated by rising prices. Uranium was not a resource in any meaningful sense before 1940.

More particularly, if a known mineral deposit cannot be mined, processed and marketed economically, it does not constitute a resource in any practical sense. Many factors determine whether a particular mineral deposit can be considered a usable resource - the scale of mining and processing, the technological expertise involved, its location in relation to markets, and so on. The application of human ingenuity, through technology, alters the significance of all these factors and is thus a second means of "creating" resources. In effect, portions of the earth's crust are reclassified as resources. A further aspect of this is at the manufacturing and consumer level, where technology can make a given amount of resources go further through more efficient use.(aluminium can mass was reduced by 21% 1972-88, and motor cars each use about 30% less steel than 30 years ago)

An excellent example of this application of technology to create resources is in the Pilbara region of Western Australia. Until the 1960s the vast iron ore deposits there were simply geological curiosities, despite their very high grade. Australia had been perceived as short of iron ore. With modern large-scale mining technology and the advent of heavy duty railways and bulk shipping which could economically get the iron ore from the mine (well inland) through the ports of Dampier and Port Hedland to Japan, these became one of the nation's main mineral resources. For the last 45 years Hamersley Iron (Rio Tinto), Mount Newman (BHP-Billiton) and others have been at the forefront of Australia's mineral exporters, drawing upon these 'new' orebodies.

Just over a hundred years ago aluminium was a precious metal, not because it was scarce, but because it was almost impossible to reduce the oxide to the metal, which was therefore fantastically expensive. With the discovery of the Hall-Heroult process in 1886, the cost of producing aluminium plummeted to about one twentieth of what it had been and that metal has steadily become more commonplace. It now competes with iron in many applications, and copper in others, as well as having its own widespread uses in every aspect of our lives. Not only was a virtually new material provided for people's use by this technological breakthrough, but enormous quantities of bauxite world-wide progressively became a valuable resource. Without the technological breakthrough, they would have remained a geological curiosity.

Incremental improvements in processing technology at all plants are less obvious but nevertheless very significant also. Over many years they are probably as important as the historic technological breakthroughs.

To achieve sustainability, the combined effects of mineral exploration and the development of technology need to be creating resources at least as fast as they are being used. There is no question that in respect to the minerals industry this is generally so, and with uranium it is also demonstrable. Recycling also helps, though generally its effect is not great.

Economics

Whether a particular mineral deposit is sensibly available as a resource will depend on the market price of the mineral concerned. If it costs more to get it out of the ground than its value warrants, it can hardly be classified as a resource (unless there is some major market distortion due to government subsidies of some kind). Therefore, the resources available will depend on the market price, which in turn depends on world demand for the particular mineral and the costs of supplying that demand. The dynamic equilibrium between supply and demand also gives rise to substitution of other materials when scarcity looms (or the price is artificially elevated). This then is the third aspect of creating resources.

The best known example of the interaction of markets with resource availability is in the oil industry. When in 1972 OPEC suddenly increased the price of oil fourfold, several things happened at both producer and consumer levels.

The producers dramatically increased their exploration effort, and applied ways to boost oil recovery from previously 'exhausted' or uneconomic wells. At the consumer end, increased prices meant massive substitution of other fuels and greatly increased capital expenditure in more efficient plant. As a result of the former activities, oil resources increased dramatically. As a result of the latter, oil use fell slightly to 1975 and in the longer perspective did not increase globally from 1973 to 1986. Forecasts in 1972, which had generally predicted a doubling of oil consumption in ten years, proved quite wrong.

Oil will certainly become scarce one day, probably before most other mineral resources, which will continue to drive its price up. As in the 1970s, this will in turn cause increased substitution for oil and bring about greater efficiencies in its use as equilibrium between supply and demand is maintained by the market mechanism. Certainly oil will never run out in any absolute sense - it will simply become too expensive to use as liberally as we now do.

Another example is provided by aluminium. During World War II, Germany and Japan recovered aluminium from kaolinite, a common clay, at slightly greater cost than it could be obtained from bauxite.

Due to the operation of these three factors the world's economically demonstrated resources of most minerals have risen faster than the increased rate of usage over the last 50 years, so that more are available now, notwithstanding liberal usage. This is largely due to the effects of mineral exploration and the fact that new discoveries have exceeded consumption.

Replacement of uranium

A characteristic of metals resource replacement is that the mineral discovery process itself adds a small cost relative to the value of the discovered metals. As an example, the huge uranium reserves of Canada's Athabasca Basin were discovered for about US$1.00/kgU (2003 dollars, including unsuccessful exploration). Similar estimates for world uranium resources, based on published IAEA exploration expenditure data and assuming that these expenditures yielded only the past uranium produced plus the present known economic resources categories at up to US$80/kg (Uranium 2003: Resources, Production and demand. Nuclear Energy Agency and IAEA, OECD Publications 2004) yields slightly higher costs of about US$1.50/kgU. This may reflect the higher component of State-driven exploration globally, some of which had national self-sufficiency objectives that may not have aligned with industry economic standards.

From an economic perspective, these exploration costs are essentially equivalent to capital investment costs, albeit spread over a longer time period. It is, however, this time lag between the exploration expense and the start of production that confounds attempts to analyse exploration economics using strict discounted cash flow methods. The positive cash flows from production occur at least 10-15 years into the future, so that their present values are obviously greatly reduced, especially if one treats the present as the start of exploration. This creates a paradox, since large resource companies must place a real value on simply surviving and being profitable for many decades into the future; and, without exploration discoveries, all mining companies must expire with their reserves. Recent advances in the use of real options and similar methods are providing new ways to understand this apparent paradox. A key insight is that time, rather than destroying value through discounting, actually adds to the option value, as does the potential of price volatility. Under this perspective, resource companies create value by obtaining future resources which can be exploited optimally under a range of possible economic conditions. Techniques such as these are beginning to add analytical support to what have always been intuitive understandings by resource company leaders - that successful exploration creates profitable mines and adds value to company shares.

Since uranium is part of the energy sector, another way to look at exploration costs is on the basis of energy value. This allows comparisons with the energy investment cost for other energy fuels, especially fossil fuels which will have analogous costs related to the discovery of the resources. From numerous published sources, the finding costs of crude oil have averaged around US$ 6/bbl over at least the past three decades. When finding costs of the two fuels are expressed in terms of their contained energy value, oil, at US$ 1050/MJ of energy, is about 300 times more expensive to find than uranium, at US$ 3.4/MJ. Similarly, the proportion of current market prices that finding costs comprise are lower for uranium. Its finding costs make up only 2% of the recent spot price of US$ 30/lb ($78/kgU), while the oil finding costs are 12% of a recent spot price of US$ 50/bbl.

By these measures, uranium is a very inexpensive energy source to replenish, as society has accepted far higher energy replacement costs to sustain oil resources. This low basic energy resource cost is one argument in favour of a nuclear-hydrogen solution to long-term replacement of oil as a transportation fuel.

Forecasting replenishment

Supply forecasters are often reluctant to consider the additive impacts of exploration on new supply, arguing that assuming discoveries is as risky and speculative as the exploration business itself. Trying to predict any single discovery certainly is speculative. However, as long as the goal is merely to account for the estimated total discovery rate at a global level, a proxy such as estimated exploration expenditures can be used. Since expenditures correlate with discovery rate, the historic (or adjusted) resources discovered per unit of expenditure will provide a reasonable estimate of resource gains to be expected. As long as the time lag between discovery and production is accounted for, this kind of dynamic forecasting is more likely to provide a basis for both price increases and decreases, which metals markets have historically demonstrated.

Without these estimates of uranium resource replenishment through exploration cycles, long-term supply-demand analyses will tend to have a built-in pessimistic bias (i.e. towards scarcity and higher prices), that will not reflect reality. Not only will these forecasts tend to overestimate the price required to meet long-term demand, but the opponents of nuclear power use them to bolster arguments that nuclear power is unsustainable even in the short term. In a similar fashion, these finite-resources analyses also lead observers of the industry to conclude that fast breeder reactor technology will soon be required. This may indeed make a gradual appearance, but if uranium follows the price trends we see in other metals, its development will be due to strategic policy decisions more than uranium becoming too expensive.

The resource economics perspective tells us that new exploration cycles should be expected to add uranium resources to the world inventory, and to the extent that some of these may be of higher quality and involve lower operating cost than resources previously identified, this will tend to mitigate price increases. This is precisely what has happened in uranium, as the low-cost discoveries in Canada's Athabasca Basin have displaced higher-cost production from many other regions, lowering the cost curve and contributing to lower prices. Secondary uranium supplies, to the extent that they can be considered as a very low-cost mine, have simply extended this price trend.

The first exploration and mining cycle for uranium occurred about 1970 to 1985. It provided enough uranium to meet world demand for some 80 years, if we view present known resources as arising from it. With the rise in uranium prices to September 2005 and the concomitant increase (boom?) in mineral exploration activity, it is clear that we have the start of a second such cycle, mid 2003 to ??. The price increase was brought about by diminution of secondary supplies coupled with a realization that primary supplies needed to increase substantially.

Several significant decisions on mine development and increased exploration by major producers will enable this expansion of supply, coupled with smaller producers coming on line. The plethora of junior exploration companies at the other end of the spectrum which are finding no difficulty whatever in raising capital are also a positive sign that a vigorous new exploration and mining cycle is cranking up. From lows of around US$ 55 million per year in 2000, world uranium exploration expenditure rose to about US$ 110 million in 2004 and is expected to be US$ 185 million in 2005, half of this being from the junior exploration sector. The new cycle is also showing considerable regional diversification. Measured from 1990, cycle 2 totals US$ 1.5 billion to 2005, compared with a total of about three times this figure (uncorrected) for the whole of the first cycle.

Depletion and sustainability

Conversely, the exhaustion of mineral resources during mining is real. Resource economists do not deny the fact of depletion, nor its long-term impact - that in the absence of other factors, depletion will tend to drive commodity prices up. But as we have seen, mineral commodities can become more available or less scarce over time if the cost-reducing effects of new technology and exploration are greater than the cost-increasing effects of depletion.

One development that would appear to argue against economic sustainability is the growing awareness of the global depletion of oil, and in some regions such as North America, natural gas. But oil is a fundamentally different material. This starts with geology, where key differences include the fact that oil and gas were formed by only one process: the breakdown of plant life on Earth. Compared with the immense volumes of rock-forming minerals in the Earth? crust, living organisms on top of it have always been a very tiny proportion. But a more important fact is that the world has consumed oil, and recently natural gas as well, in a trajectory of rapid growth virtually unmatched by any other commodity. Consumption growth rates of up to 10% annually over the past 50 years are much higher than we see for other commodities, and support the contention that oil is a special depletion case for several reasons: its geological occurrence is limited, it has been inexpensive to extract, its energy utility has been impossible to duplicate for the price, and its resulting depletion rates have been incredibly high.

This focus on rates of depletion suggests that one of the dimensions of economic sustainability of metals has to do with their relative rates of depletion. Specifically, it suggests that economic sustainability will hold indefinitely as long as the rate of depletion of mineral resources is slower than the rate at which it is offset. This offsetting force will be the sum of individual factors that work against depletion, and include cost-reducing technology and knowledge, lower cost resources through exploration advances, and demand shifting through substitution of materials.

An economic sustainability balance of this type also contemplates that, at some future point, the offsetting factors may not be sufficient to prevent irreversible depletion-induced price increases, and it is at this point that substituting materials and technologies must come into play to take away demand. In the case of rapid oil depletion, that substitute appears to be hydrogen as a transport fuel. Which raises the question of how the hydrogen is produced, and nuclear energy seems the most likely means of that, using high-temperature reactors.

From a detached viewpoint all this may look like mere technological optimism. But to anyone closely involved it is obvious and demonstrable. Furthermore, it is illustrated by the longer history of human use of the Earth's mineral resources. Abundance, scarcity, substitution, increasing efficiency of use, technological breakthroughs in discovery, recovery and use, sustained incremental improvements in mineral recovery and energy efficiency - all these comprise the history of minerals and humankind.

Appendix 2.

Mineral Resources and Reserves

The International Template for Reporting of Exploration Results, Mineral Resources and Mineral Reserves (July 2006) integrates the minimum standards being adopted in national reporting codes worldwide with recommendations and interpretive guidelines for the Public Reporting of Exploration Results, Mineral Resources and Mineral Reserves. The definitions (below) in this edition of the International Reporting Template are either identical to, or not materially different from those definitions used in the countries represented on the Committee for Mineral Reserves International Reporting Standards (CRIRSCO), notably Australia, whose JORC code was the basis of these international definitions, and Canada (NI 43-101 code).

A ‘Mineral Resource’ is a concentration or occurrence of material of intrinsic economic interest in or on the Earth’s crust in such form, quality and quantity that here are reasonable prospects for eventual economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence, sampling and knowledge. Mineral Resources are sub-divided, in order of increasing geological confidence, into Inferred, Indicated and Measured categories.

An ‘Inferred Mineral Resource’ is that part of a Mineral Resource for which tonnage, grade and mineral content can be estimated with a low level of confidence. It is inferred from geological evidence and assumed but not verified geological and/or grade continuity. It is based on information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes which is limited or of uncertain quality and reliability.

An ‘Indicated Mineral Resource’ is that part of a Mineral Resource for which tonnage, densities, shape, physical characteristics, grade and mineral content can be estimated with a reasonable level of confidence. It is based on exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes. The locations are too widely or inappropriately spaced to confirm geological and/or grade continuity but are spaced closely enough for continuity to be assumed.

A ‘Measured Mineral Resource’ is that part of a Mineral Resource for which tonnage, densities, shape, physical characteristics, grade and mineral content can be estimated with a high level of confidence. It is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes. The locations are spaced closely enough to confirm geological and grade continuity.

A ‘Mineral Reserve’ (or Ore Reserve) is the economically mineable part of a Measured and/or Indicated Mineral Resource. It includes diluting materials and allowances for losses, which may occur when the material is mined. Appropriate assessments and studies will have been carried out, and include consideration of and modification by realistically assumed mining, metallurgical, economic, marketing, legal, environmental, social and governmental factors. These assessments demonstrate at the time of reporting that extraction could reasonably be justified. Mineral or Ore Reserves are sub-divided in order of increasing confidence into Probable Mineral/Ore Reserves and Proved Mineral/Ore Reserves.

A ‘Probable Mineral Reserve’ (or Probable Ore Reserve) is the economically mineable part of an Indicated, and in some circumstances, a Measured Mineral Resource. It includes diluting materials and allowances for losses which may occur when the material is mined. Studies to at least Pre-Feasibility level will have been carried out, including consideration of and modification by realistically assumed mining, metallurgical, economic, marketing, legal, environmental, social and governmental factors. The results of the studies demonstrate at the time of reporting that extraction could reasonably be justified.

A ‘Proved Mineral Reserve’ (or proved Ore Reserve) is the economically mineable part of a Measured Mineral Resource. It includes diluting materials and allowances for losses which may occur when the material is mined. Studies to at least Pre-Feasibility level will have been carried out, including consideration of and modification by realistically assumed mining, metallurgical, economic, marketing, legal, environmental, social and governmental factors. These studies demonstrate at the time of reporting that extraction is justified.